top message

Connecting the Past 10 Years with

the Next 10 Years

In 2016, we defined what Kagome strives for by 2025?“To become a strong company capable of sustainable growth, using food as a means of resolving social issues”?and our vision of “Transform from a ‘tomato company’ to a ‘vegetable company.’” Since then, we have implemented three mid-term management plans, from the first to the third. FY2025 marks the final year of our third Mid-term Management Plan and a culmination of our activities over the past decade. This also coincides with the formulation of our growth strategy for the next 10 years.

Over the past decade, the business environment surrounding Kagome has changed dramatically. The nearly four-year long COVID-19 pandemic significantly changed people’s values and consumption behavior. This was followed by unprecedented cost increases triggered by rising geopolitical risks worldwide, causing the Japanese economy to shift from a long period of deflation to inflation. As the effects of climate change become more severe, sourcing the agricultural raw materials vital to our operations is becoming more difficult with each passing year.

Given this situation, we will take a careful look back at the accomplishments and challenges we have faced over the past decade as we have pursued sustainable growth. In turn, we will utilize this knowledge to build on the next 10 years.

Looking Back on Kagome’s Performance

During the Three Mid-Term Management

Plans

The first and second mid-term management plans helped us overcome sluggish performance and improve our bottom line

In FY2015, the year before the start of the first Mid-Term Management Plan, Kagome faced an extremely challenging business situation, with our operating margin (JGAAP) falling to 3.4%, due to the impact of elevated raw materials prices that had continued since 2013. To overcome this critical situation, we announced the implementation of new management reforms, and in FY2016 we embarked on a 10-year challenge to become a strong company capable of sustainable growth.

The initial blueprint for the past 10 years was to restore profit margins through extensive reforms of our earnings structure during the first Mid-Term Management Plan (2016?2018), and to put both revenue and core operating income on a growth trajectory during the second Mid-Term Management Plan (2019?2021), while sowing the seeds of growth. The goal was to achieve sustainable growth during the third Mid-Term Management Plan (2022?2025).

During the first Mid-Term Management Plan, the entire company worked to eliminate muri, mura, and muda (unreasonableness, inconsistency, and waste). As a result, we managed to improve our operating margin (JGAAP), which was 3.4% in FY2015, to 5.7% in FY2018.

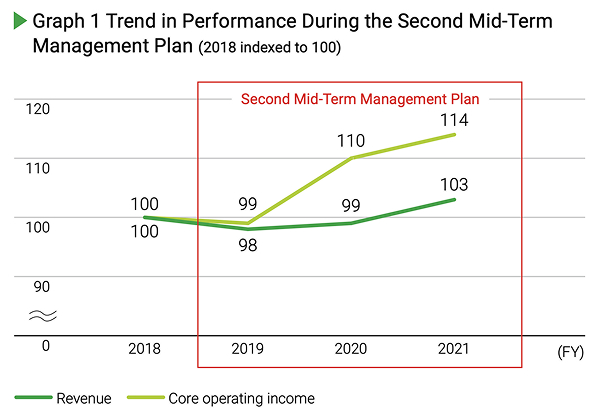

During the second Mid-Term Management Plan, we worked to grow both revenue and core operating income, but the results were mixed. Graph 1 shows the revenue and core operating income (IFRS) for each fiscal year, with the year prior to the second Mid-Term Management Plan (2018) indexed to 100. During the second Mid-Term Management Plan, although core operating income recovered steadily, we were unable to put revenue on a growth trajectory.At that time, we keenly felt that Kagome lacked the power to sow the seeds of growth and acquire new revenue.

Shifting the focus to growth in the third Mid-Term Management Plan

Reflecting on the second Mid-Term Management Plan, which left issues in terms of revenue growth, the third Mid-Term Management Plan divided Kagome’s intended growth direction into two: organic growth (growth of existing businesses) and inorganic growth (growth through alliances and M&A). The Plan also clarifies the organizations and strategies for advancing each.

Regarding organic growth in the Domestic Processed Food Business, our basic strategy was to strengthen relationships with customers through company-wide efforts to increase vegetable intake and promote fan-based marketing, while also focusing on increasing demand for vegetable beverages and tomato condiments to achieve stable growth. In addition, we set vegetable soup, plant-based food, and D2C (direct to consumer) as business expansion domains and strengthened our activities to acquire new revenue sources. In the International Business, we worked to expand our supply share among existing global food service customers by strengthening collaboration between overseas Group companies

Our top priority in inorganic growth has been to explore business opportunities targeting the North American market, where the population continues to grow and a solid social infrastructure is already in place. To advance these efforts, we established the US Growth Strategy Department and a Business Development Office to explore a wide range of partnership opportunities.

Progress of the third Mid-Term Management Plan

Over the three-year period from 2022 to 2024, in the domain of organic growth, we faced unprecedented and significant cost increases in both our domestic and international business operations. In particular, the international market price of tomato paste, our main raw material, soared due to a combination of the sharp uptick in demand for eating out as the economy restarted after the COVID-19 pandemic and poor harvest conditions for tomatoes as a result of worsening climate change. Prices of other raw materials and energy also continued to move higher amid increasing geopolitical risks.

In response to these significantly higher costs, we implemented price revisions for our mainstay products in the Domestic Processed Food Business for three consecutive years starting from FY2022. In our International Business, we also engaged in detailed price negotiations with major customers and focused on revising prices to reflect our higher costs.

In addition to price revisions, in the Domestic Processed Food Business, we actively implemented measures to stimulate demand for vegetable beverages and tomato condiments, which were a basic strategy of the third Mid-Term Management Plan. We also made persistent efforts to expand sales of vegetable soups and other food products.

In the domain of inorganic growth, our newly established promotion organization led the way to create a list of various alliance and M&A opportunities. From that list, we made Ingomar Packing Company, LLC (below, “Ingomar”) based in California, a consolidated subsidiary in January 2024, with the objective of accelerating the growth of our International Business and building a competitive tomato processing business.

Thanks to these activities, the Domestic Processed Food Business managed to restore the portion of its sales volume that had declined due to price revisions at a faster pace than expected, and core operating income, which had been declining, reversed course upward in 2023. In the International Business, both revenue and core operating income grew significantly driven by the strong tomato paste market conditions and the consolidation of Ingomar.

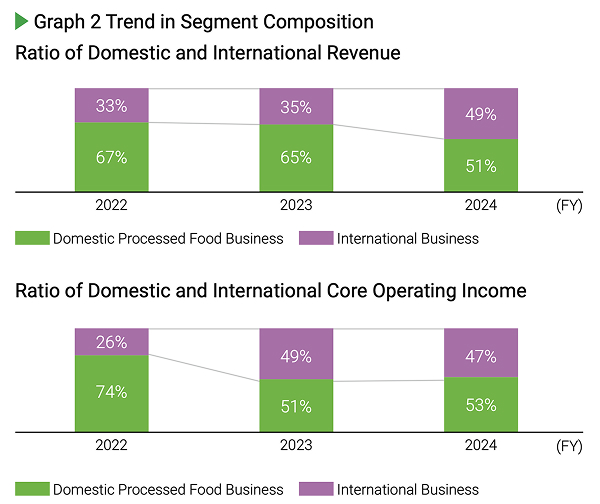

As a result, our performance in 2024 exceeded the targets of the third Mid-Term Management Plan, which were revenue of 300 billion yen and core operating income of 24 billion yen. As shown in Graph 2, the Kagome Group’s business structure has seen an increase in the proportion of revenue and core operating income from the International Business, and core operating income in particular has undergone a major change, with the domestic and international segments now accounting for roughly half of the total each.

Looking Back on Our Initiatives to Address

Social Issues

In the three mid-term management plans since FY2016, we have worked to resolve three social issues: namely, “Longer, healthier lives” “Agricultural development and regional revitalization,” and “Sustainable global environment.” At the same time, we have continued to work to connect these efforts to sustainable growth. Below, I would like to look back on our efforts for each as well as summarize achievements and challenges.

Longer, healthier lives

Various studies conducted around the world have shown that eating lots of vegetables is beneficial for staying healthy every day. Based on these findings, Japan’s Ministry of Health, Labour and Welfare recommends consuming at least 350 grams of vegetables per day. However, actual intake has remained stuck at around 260 to 290 grams for a long period of time.

To address this issue, we launched the Let’s Eat Vegetables Campaign in 2020. The campaign mainly seeks to popularize the use of VegeCheckR, a device developed to “visualize” estimated vegetable intake and raise awareness among many consumers of their vegetable deficiency. By continuing to install the VegeCheckR in retail stores and provide information to companies that promote health management, the cumulative number of measurements exceeded 13 million by the end of 2024. In lockstep, awareness of VegeCheckR has steadily risen. However, a survey by the Ministry of Health, Labour and Welfare shows that the vegetable intake of Japanese people continues to decline. We will continue to strengthen our efforts with the aim of promoting behavioral change in consumers’ eating habits and producing results that will impact society, e.g., actually increasing people’s vegetable intake.

Agricultural development and regional revitalization / Sustainable global environment

With regard to “Agricultural development and regional revitalization,” we have been offering the Yasai Seikatsu 100 Seasonal Series of products since 2010. This lineup is based on the idea of “locally grown, nationally consumed,” where we blend fruits grown in each region with the Yasai Seikatsu brand and distribute these products nationwide. Additionally, for producers of domestic tomatoes used to make juice, we are working to mechanize harvesting operations as a way to address the aging farm workforce and labor shortages. In order to maintain and expand production areas, Kagome employees known as field persons visit producers in-person to listen to their various needs and requests. This includes lending out harvesting machines developed by Kagome or providing guidance on cultivation methods suited to mechanized harvesting.

With regard to “Sustainable global environment,” based on our Quality and Environmental Policy established in 2017, the entire Kagome Group, including overseas subsidiaries, encourages the installation of solar power generation systems and the use of biomass energy to reduce greenhouse gas emissions. Additionally, in 2020, we established the Kagome Policy on Plastics, with the goal of eliminating petroleum-based straws attached to our beverage cartons by 2030 and replacing more than 50% of PET beverage bottle resin with recycled or plant-based materials.

As described above, we have made steady progress in our efforts to resolve the three social issues. Going forward, we will further strengthen these efforts and augment our ability to ensure that these efforts lead to the Group’s sustainable growth.

Priority Issues for FY2025

When FY2025 began, the business environment was characterized by falling international market prices for tomato paste. This is due to the higher volume of tomato paste processed following increased processing tomato production in FY2024, which eliminated the previous inventory shortage. While we had anticipated such fluctuations in the tomato paste market, the business environment in 2025 will be extremely challenging due to the impacts. Nevertheless, even in this environment, we aim to achieve the targets of our third Mid-Term Management Plan of 300 billion yen in revenue and 24 billion yen in core operating income for the second consecutive year. We hope to use these results to solidify our earnings base for the next decade.

The priority issue for the Domestic Processed Food Business in FY2025 is to restore profits and continue taking on challenges. Various costs outside of tomato paste are expected to continue rising. Given this, our goal is to exceed the core operating income achieved in FY2021, before costs began to rise, ensuring we restore profits.

To that end, in 2025 we will continue to focus on growing demand for our mainstay products. In the Beverages category, we will keep in place measures to maintain strong sales of tomato juice and also step up promotions of Yasai Seikatsu 100, which will mark its 30th anniversary in 2025. As for the food category, we will expand information dissemination about tomato ketchup, tomato condiments, and other products, focused on Kagome Napolitan Stadium 2025, an event that will determine the best Japanese ketchup spaghetti dishes in Japan. With regard to continuing to take on challenges, we will also expand business domains with a focus on almond milk, in addition to current activities. As a specific measure, we will begin full-scale marketing of almond milk brand Almond BreezeR from spring 2025.

The priority issue for our International Business is accelerating growth overseas. We will turn around the decline in profits from primary processed tomatoes by expanding the volume of secondary processed tomatoes, which is less susceptible to tomato paste market conditions. Specifically, we will work to expand our customer base from global food service companies to local food service companies and to expand our flavored products beyond simply tomato. At the same time, for primary processed tomatoes, we will work to reduce earnings volatility by increasing the frequency of monitoring trading prices and implementing flexible pricing policies.

Regarding inorganic growth, we will continue to explore various possibilities that will help to strengthen our value chain in the medium- to long-term.

Aiming for Greater Growth over

the Next Decade

Formulation of the 2035 Vision

We are currently formulating our 2035 Vision, which will guide the Kagome Group’s actions for the next decade. Prior to this, we held a number of internal discussions about the need for a long-term vision in an era of rapid and unpredictable change, including the worsening of climate change and the rapid spread of AI. As a result, we came to the conclusion that the Kagome Group needs a long-term vision after all, because we engage in business with the idea of creating value from agriculture.

Agriculture operates on a yearly cycle. Kagome has been in business for 126 years, but in that time we have only grown tomatoes 126 times. Unlike industrial products, which can be produced a huge number of times in a year, in agriculture, simply introducing new plant varieties and cultivation techniques takes a considerable amount of time. For this reason, we felt that we needed a longterm vision to determine the direction we should take over a span of around 10 years and move forward step by step toward that direction under a consistent policy.

From this, we began formulating our 2035 Vision in November 2023, and after various discussions over the past year or so, we have come to see two directions that Kagome should strive for. First, we will further elevate our ability to develop solutions to address the challenges facing agriculture and the global environment. More specifically, we will contribute to the realization of sustainable agriculture by developing plant varieties and cultivation techniques that can address the worsening effects of climate change, thereby reducing environmental impacts and making us more cost competitive. The other direction is contributing to people’s physical and mental well-being through food and agriculture. In addition to our current efforts to promote physical well-being with vegetables, we would like to expand the scope of our activities to include mental well-being and contribute to the healthy daily living of all.

We presented these two directions internally in October 2024, and now, we are working on finalizing the details of each. Going forward, we will continue these discussions within the company and create a vision that incorporates the ideas of as many employees as possible.

Remain unchanged for the next 10 years

To realize our 2035 Vision, it is crucial that we continually challenge ourselves to explore new possibilities. At the same time, we need a “core idea” that brings consistency to each individual challenge. We believe that such a core idea can be summed up in the following three ideas that we have cultivated over the past 10 years.

The first is that we contribute to society by solving social issues, and through that, Kagome will also grow. Until now, we have been working to resolve three social issues. However, as mentioned above in “Looking back on our initiatives to address social issues,” although we have made progress in various ways, we still lack the ability to translate these activities into sustainable growth for the company. Over the next decade, we need to maintain this mindset and aim to produce even more impactful results.

The second is creating value from agriculture and delivering it to customers. This is Kagome’s DNA and has remained unchanged since our founder, Ichitaro Kanie, first attempted to cultivate tomatoes commercially in Japan. We believe that continuing to further evolve and refine our globally unique “agriculture-based value chain” will boost our competitiveness.

The third is our approach of pursuing growth in global markets, including Japan. As mentioned above, our actions over the past 10 years have today placed us third in the world in tomato processing volume. These same actions have also strengthened our organization with major Group companies now located in North America, Europe, Australia, and Japan. By strengthening collaboration within this global network and creating synergies, we will be able to accelerate our growth.

Strengthening the business base

For Kagome to achieve sustainable growth over the next decade, we must strengthen the business base underpinning this growth. Of particular importance is strengthening agricultural and health research and creating a company where people feel job satisfaction.

As climate change becomes more severe, it will become more difficult to access stable sources of agricultural raw materials. To change this situation on our own, we will need to strengthen agricultural research, which is at the very top of the value chain. Towards this goal, we have been establishing an agricultural research system since FY2023. In October 2023, we established the Global Agricultural Research & Business Center, consolidating our agricultural research bases that were previously scattered both domestically and overseas. Then, in September 2024, we launched a corporate venture capital fund in Silicon Valley with a total investment of 50 million US dollars and a 10-year investment horizon. Going forward, we will promote open innovation with start-up companies that possess innovative agricultural technologies, while incorporating this knowledge within the Kagome Group to accelerate the development of new plant varieties and cultivation techniques that can be adapted to climate change.

Furthermore, contributing to our customers’ well-being will remain at the heart of our value proposition. In the process of formulating the 2035 Vision, we are discussing expanding the scope of our contributions from physical to mental well-being. In line with this direction, we will also work to expand the scope of research into mental well-being.

With regard to becoming a company where employees feel job satisfaction, during the third Mid-Term Management Plan we have focused on introducing an engagement survey and spreading the idea of psychological safety. However, when asked whether these efforts have transformed our corporate culture into one where both the organization and individuals are highly motivated and continue to grow, the answer remains unclear. One of the causes of this lies in our current personnel system. Our personnel system is based on the assumption that employees will spend a long time at the company in becoming proficient. This has fallen behind the major changes in people’s attitudes toward work, such as the idea of “work-life career,” which involves comprehensively planning not only your job but also your life. It also does not take into account the increasing number of people who are building their careers by improving their skills at multiple companies rather than remaining with just one company. In order to change this situation and create “autonomous, self-reliant” teams that can produce innovation and continue to grow, we began a fundamental reform of our personnel system starting in FY2024. People will continue to be the driving force behind Kagome’s growth, and while we adhere to our fundamental philosophy of “valuing people,” we want to expand the options for working styles to accommodate diverse views on work.

Message to Stakeholders

Over the past 10 years, Kagome has undergone significant changes. These include our business structure, attitude, and the way we are viewed by stakeholders. We believe that deepening engagement with our fan shareholders who have supported Kagome over the years, as well as with investors both in Japan and overseas, and receiving opinions from new perspectives in this process, will unlock greater growth for the Kagome Group.

We will continue to pursue the idea that creating value from agriculture will resolve social issues, which will in turn lead to the growth of the Kagome Group, as we continue to evolve our unique value chain from field to dining table. By doing so, we will achieve our performance targets for FY2025 and continue working hard to enhance our corporate value over the next decade. I ask for your continued support going forward.